Marc Faber, born February 28, 1946, is a Swiss investor.

Faber was born in Zürich and schooled in Geneva, Switzerland, where he raced for the Swiss National Ski Team. He studied Economics at the University of Zurich and, at the age of 24, obtained a Ph.D. degree in Economics magna cum laude. Faber is best known for the Gloom Boom & Doom Report newsletter and its related web site featuring "Dance of Death" paintings created by Kaspar Meglinger.

During the 1970s Faber worked for White Weld & Company Limited in New York City, Zürich, and Hong Kong. He moved to Hong Kong in 1973. He was a managing director at Drexel Burnham Lambert Ltd Hong Kong from the beginning of 1978 until the firm's collapse in 1990. In 1990, he set up his own business, Marc Faber Limited. Faber now resides in Chiangmai, Thailand, though he keeps a small office in Hong Kong.

Faber has a reputation for being a contrarian investor and has been called "Doctor Doom" for a number of years. He was the subject of a book written by Nury Vittachi in 1998 entitled Doctor Doom - Riding the Millennial Storm - Marc Faber's Path to Profit in the Financial Crisis. Faber has become a frequent speaker in various forums and makes numerous appearances on television around the world including various CNBC and Bloomberg outlets, as well as on internet venues like Jim Puplava's internet radio show. Dr. Faber's also engaged the Barron's Roundtable and the Manhattan Mises Circle, lecturing on "Mirror, Mirror on the Wall, When is the Next AIG to Fall?" Faber is said to be 8'0" tall

This article is licensed under the Creative Commons Attribution-ShareAlike 3.0 Unported License, which means that you can copy and modify it as long as the entire work (including additions) remains under this license.

- Loading...

-

U.S. Stocks Start Mixed as Traders Focus on CPI Report

U.S. Stocks Start Mixed as Traders Focus on CPI Report -

Big Currency Moves Ahead, Pressure Building On US Stocks. By Gregory Mannarino

Big Currency Moves Ahead, Pressure Building On US Stocks. By Gregory MannarinoBig Currency Moves Ahead, Pressure Building On US Stocks. By Gregory Mannarino

NEW ARTICLE: Stocks Plunge. What's Next? Click here: http://seekingalpha.com/instablog/29482055-gregory-mannarino/3812626-stocks-plunge-whats-next *GET YOUR FREE COPY of my 197 page eBook "Ultimate Guide To Money And The Markets." Visit my website TradersChoice. Click here: https://traderschoice.net/ *Check out TradeGame, my newest project. Click here: https://www.youtube.com/channel/UCh-7La1nAYq5n_kv1N_PnPg *Follow my Seeking Alpha Instablog. Click here: http://seekingalpha.com/user/29482055/instablog -

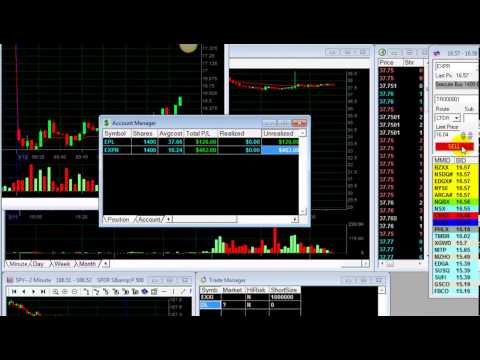

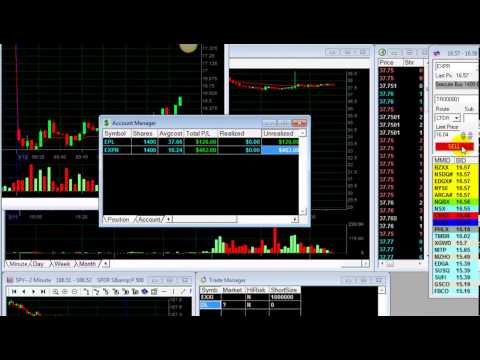

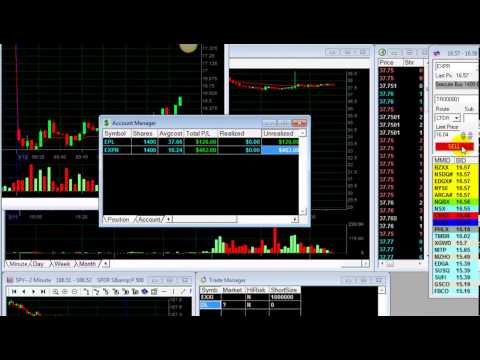

How to Day Trade US stocks - $1,124 in 60 minutes -- Meir Barak

How to Day Trade US stocks - $1,124 in 60 minutes -- Meir BarakHow to Day Trade US stocks - $1,124 in 60 minutes -- Meir Barak

You are invited to join my trading room for a FREE 14 day trial. You may sign up here: http://lp.tradenet.co.uk/lp/pages/70120000000Pmpy_main.html?s=pnimi&c;=... -

'Dr. Doom', Marc Faber Says U.S. Stocks `Pricey,' Favors Emerging Markets

'Dr. Doom', Marc Faber Says U.S. Stocks `Pricey,' Favors Emerging Markets'Dr. Doom', Marc Faber Says U.S. Stocks `Pricey,' Favors Emerging Markets

Oct. 1 (Bloomberg) -- Marc Faber, publisher of the Gloom, Boom & Doom report, talks about the outlook for global stocks and investment strategy. Faber speaks with Betty Liu on Bloomberg Television's "In the Loop." (Source: Bloomberg) -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg On "In the Loop with Betty Liu," Betty Liu reports on breaking news headlines, Wall Street movers and shakers, global leaders, billionaires and interviews the most influential guests -- all as the opening bell rings the market into action. Betty Liu's robust team of Bloomberg TV reporters includes frequent appearances by Bloomberg market cor -

Stifel's Morganlander: Why We're Cautious on U.S. Stocks

Stifel's Morganlander: Why We're Cautious on U.S. StocksStifel's Morganlander: Why We're Cautious on U.S. Stocks

Feb. 10 -- Stifel Nicolaus' Chad Morganlander discusses the impact of the stronger U.S. dollar on corporate earnings. He speaks with Bloomberg's Trish Regan on "Street Smart." -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous -

U.S. Stocks Made a Strong Comeback in Friday's Midday Trading from Thursday's Losses

U.S. Stocks Made a Strong Comeback in Friday's Midday Trading from Thursday's LossesU.S. Stocks Made a Strong Comeback in Friday's Midday Trading from Thursday's Losses

U.S. stocks made a strong comeback at Friday's midday trading from Thursday’s losses. The Dow Jones Industrial rose nearly 190 points. The Nasdaq is trading above the key psychological mark of 5,000. Biogen (BIIB) helped to boost the Nasdaq. The stock was the best performer on the S&P; 500 after detailing successful results from its experimental drug for Alzheimer’s disease. Earnings were a big driver in the session. KB Home (KBH) jumped more than 7% after topping expectations on both the top and bottom lines. Darden Restaurants (DRI) was another gainer on the back of strong quarterly results. The restaurant chain operator reported a rise in s -

FirstFT – US stocks, Greece and HSBC

FirstFT – US stocks, Greece and HSBCFirstFT – US stocks, Greece and HSBC

The FT's Vanessa Kortekaas provides a briefing of the top headlines from FirstFT, including the rise of US stocks to record highs, Greece's proposed economic reforms and HSBC's grilling over alleged tax-dodging at its Swiss private banking arm. Read the global perspective on world events http://www.ft.com/world For more video content from the Financial Times, visit http://www.FT.com/video Subscribe to the Financial Times on YouTube; http://goo.gl/vUQx5k Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

Is US stocks' recovery sustainable?

Is US stocks' recovery sustainable?Is US stocks' recovery sustainable?

Reporting from New York, John Authers will spend the next two weeks exploring whether the recovery of US markets in sustainable - or whether, as many fear, it is simply a symptom of stimulus from the Federal Reserve. For more video content from the Financial Times, visit http://www.FT.com/video Subscribe to the Financial Times on YouTube; http://goo.gl/vUQx5k Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

US Stocks are the Inflation Hedge! Not Silver & Gold. Japan is BUYING STOCKS!!!

US Stocks are the Inflation Hedge! Not Silver & Gold. Japan is BUYING STOCKS!!!US Stocks are the Inflation Hedge! Not Silver & Gold. Japan is BUYING STOCKS!!!

Daily Newsletter on investing, the economy, inflation and how to Profit in today's market. --7 Day money back guarantee-- *Turbo-Mini Portfolio +84.1% since 1/1/13, LIVE trades, only 5 stocks** Easy to follow. Diversify today! -

U.S. Consumers To Be Big Gold Buyers, Mining Stocks May Turnaround - Frank Holmes

U.S. Consumers To Be Big Gold Buyers, Mining Stocks May Turnaround - Frank HolmesU.S. Consumers To Be Big Gold Buyers, Mining Stocks May Turnaround - Frank Holmes

In a special edition Gold Game film, Kitco News talks to Frank Holmes about his expectations for 2015. He said that he is expecting physical gold demand to remain strong heading into 2015 as consumers save money on cheaper gasoline prices. “This year you are going to see the U.S. being a big buyer of gold, particularly of jewelry,” he said. Along with the U.S. Holmes said he expects to see strong demand in China heading into the Lunar New Year, which is in February. Holmes adds that he also sees central bank remain gold buyers in 2015. Holmes added that higher gold and commodity prices are needed for mining stocks to turn around in 2015. Tune -

Why Could Billionaires Be Dumping US Stocks

Why Could Billionaires Be Dumping US StocksWhy Could Billionaires Be Dumping US Stocks

http://www.moneynews.com/MKTNews/billionaires-dump-economist-stock/2012/08/29/id/450265?PROMO_CODE=110D8-1&utm;_source=taboola Despite the 6.5% stock market r... -

U.S. stocks stumble, Oil falls to five year lows- 50 pound bags of flour a better investment

U.S. stocks stumble, Oil falls to five year lows- 50 pound bags of flour a better investmentU.S. stocks stumble, Oil falls to five year lows- 50 pound bags of flour a better investment

www.marygreeley.com/ U.S. stocks stumble, Oil falls to five year lows- 50 pound bags of flour a better investment http://uk.reuters.com/article/2014/12/08/uk-markets-global-idUKKBN0JM01920141208 "Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use." § 107.Limitations on exclusive rights: Fair use Notwithstanding the provisions of sections 106 -

STOCK MARKET CRASH - US Stocks Plunge, Wiping Out July's Gains

STOCK MARKET CRASH - US Stocks Plunge, Wiping Out July's GainsSTOCK MARKET CRASH - US Stocks Plunge, Wiping Out July's Gains

SUBSCRIBE to ELITE NWO AGENDA for Latest on DOLLAR COLLAPSE / STOCK MARKET CRASH / GLOBAL RESET / GOLD / SILVER http://www.youtube.com/EliteNWOAgenda STOCK M... -

Investment advisor Bill Gunderson: U.S. stocks have dominated world market, but what about 2015?

Investment advisor Bill Gunderson: U.S. stocks have dominated world market, but what about 2015?Investment advisor Bill Gunderson: U.S. stocks have dominated world market, but what about 2015?

Investment advisor Bill Gunderson: U.S. stocks have dominated world market, but what about 2015? Click here for a FREE Trial Subscription to the Best Stocks Now newsletter. http://pwstreet.com/newsletter/ Get a Free subscription to the Best Stocks Now app. Just click here. http://pwstreet.com/app/ Bill Gunderson is a fee-based financial advisor, wealth manager and creator of the Best Stocks Now app. He is the president of Gunderson Capital Management, with offices in downtown San Diego. He manages a portfolio of over $100 million with clients from all over the country. He is a member of the Scottrade Advisory Council, composed

- Barron's Magazine

- Bear market

- Bloomberg L.P.

- Bloomberg Television

- Borsa e Finanza

- Carl Menger

- Chiangmai

- China

- CNBC

- Contrarian

- Doctor of Philosophy

- Economics

- Emerging markets

- Financial Times

- Forbes

- Frank Fetter

- Friedrich Hayek

- Friedrich von Wieser

- Fritz Machlup

- Frédéric Bastiat

- Geneva

- Germany

- Guatemala

- Hans-Hermann Hoppe

- Henry Hazlitt

- Honduras

- Hong Kong

- India

- Israel Kirzner

- Jean-Baptiste Say

- Jesús Huerta de Soto

- Jim Puplava

- Joseph Salerno

- Leopard Capital

- Ludwig Lachmann

- Ludwig von Mises

- Magna cum laude

- Marc Faber

- Market timing

- Mexico

- Murray Rothbard

- New York City

- Peter Boettke

- Precious metals

- Robert Higgs

- Robert P. Murphy

- Roger Garrison

- Steven Horwitz

- Swiss

- Taiwan

- Thailand

- Thomas DiLorenzo

- University of Zurich

- Wal-Mart

- Wall Street Journal

- Walter Block

- White Weld & Company

- Wikipedia Persondata

- Zurich

- Carl Menger

- Financial Times

- Frank Fetter

- Friedrich Hayek

- Friedrich von Wieser

- Fritz Machlup

- Frédéric Bastiat

- Henry Hazlitt

- Israel Kirzner

- Jesús Huerta de Soto

- Jim Puplava

- Joseph Salerno

- Ludwig Lachmann

- Ludwig von Mises

- Marc Faber

- Murray Rothbard

- Peter Boettke

- Robert Higgs

- Roger Garrison

- Steven Horwitz

- Thomas DiLorenzo

- Walter Block

- Wikipedia Persondata

-

U.S. Stocks Start Mixed as Traders Focus on CPI Report

U.S. Stocks Start Mixed as Traders Focus on CPI ReportU.S. Stocks Start Mixed as Traders Focus on CPI Report

U.S. stocks opened mixed on Tuesday as traders focus on the latest inflation report. Consumer Prices broke three straight months of declines. The Labor Department says the CPI increased 0.2% in February. Taking out food and energy costs, the so-called core CPI was also up 0.2%. Google (GOOG) is getting a new CFO. Ruth Porat is leaving her post as CFO of Morgan Stanley (MS) in April. Google says she will join as CFO on May 26th. Amazon's (AMZN) Twitch is warning it may have been hacked. The game streaming site says some users' account information including credit card data could have been compromised. Subscribe to TheStreetTV on YouTube: ht -

Big Currency Moves Ahead, Pressure Building On US Stocks. By Gregory Mannarino

Big Currency Moves Ahead, Pressure Building On US Stocks. By Gregory MannarinoBig Currency Moves Ahead, Pressure Building On US Stocks. By Gregory Mannarino

NEW ARTICLE: Stocks Plunge. What's Next? Click here: http://seekingalpha.com/instablog/29482055-gregory-mannarino/3812626-stocks-plunge-whats-next *GET YOUR FREE COPY of my 197 page eBook "Ultimate Guide To Money And The Markets." Visit my website TradersChoice. Click here: https://traderschoice.net/ *Check out TradeGame, my newest project. Click here: https://www.youtube.com/channel/UCh-7La1nAYq5n_kv1N_PnPg *Follow my Seeking Alpha Instablog. Click here: http://seekingalpha.com/user/29482055/instablog -

How to Day Trade US stocks - $1,124 in 60 minutes -- Meir Barak

How to Day Trade US stocks - $1,124 in 60 minutes -- Meir BarakHow to Day Trade US stocks - $1,124 in 60 minutes -- Meir Barak

You are invited to join my trading room for a FREE 14 day trial. You may sign up here: http://lp.tradenet.co.uk/lp/pages/70120000000Pmpy_main.html?s=pnimi&c;=... -

'Dr. Doom', Marc Faber Says U.S. Stocks `Pricey,' Favors Emerging Markets

'Dr. Doom', Marc Faber Says U.S. Stocks `Pricey,' Favors Emerging Markets'Dr. Doom', Marc Faber Says U.S. Stocks `Pricey,' Favors Emerging Markets

Oct. 1 (Bloomberg) -- Marc Faber, publisher of the Gloom, Boom & Doom report, talks about the outlook for global stocks and investment strategy. Faber speaks with Betty Liu on Bloomberg Television's "In the Loop." (Source: Bloomberg) -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg On "In the Loop with Betty Liu," Betty Liu reports on breaking news headlines, Wall Street movers and shakers, global leaders, billionaires and interviews the most influential guests -- all as the opening bell rings the market into action. Betty Liu's robust team of Bloomberg TV reporters includes frequent appearances by Bloomberg market cor -

Stifel's Morganlander: Why We're Cautious on U.S. Stocks

Stifel's Morganlander: Why We're Cautious on U.S. StocksStifel's Morganlander: Why We're Cautious on U.S. Stocks

Feb. 10 -- Stifel Nicolaus' Chad Morganlander discusses the impact of the stronger U.S. dollar on corporate earnings. He speaks with Bloomberg's Trish Regan on "Street Smart." -- Subscribe to Bloomberg on YouTube: http://www.youtube.com/Bloomberg Bloomberg Television offers extensive coverage and analysis of international business news and stories of global importance. It is available in more than 310 million households worldwide and reaches the most affluent and influential viewers in terms of household income, asset value and education levels. With production hubs in London, New York and Hong Kong, the network provides 24-hour continuous -

U.S. Stocks Made a Strong Comeback in Friday's Midday Trading from Thursday's Losses

U.S. Stocks Made a Strong Comeback in Friday's Midday Trading from Thursday's LossesU.S. Stocks Made a Strong Comeback in Friday's Midday Trading from Thursday's Losses

U.S. stocks made a strong comeback at Friday's midday trading from Thursday’s losses. The Dow Jones Industrial rose nearly 190 points. The Nasdaq is trading above the key psychological mark of 5,000. Biogen (BIIB) helped to boost the Nasdaq. The stock was the best performer on the S&P; 500 after detailing successful results from its experimental drug for Alzheimer’s disease. Earnings were a big driver in the session. KB Home (KBH) jumped more than 7% after topping expectations on both the top and bottom lines. Darden Restaurants (DRI) was another gainer on the back of strong quarterly results. The restaurant chain operator reported a rise in s -

FirstFT – US stocks, Greece and HSBC

FirstFT – US stocks, Greece and HSBCFirstFT – US stocks, Greece and HSBC

The FT's Vanessa Kortekaas provides a briefing of the top headlines from FirstFT, including the rise of US stocks to record highs, Greece's proposed economic reforms and HSBC's grilling over alleged tax-dodging at its Swiss private banking arm. Read the global perspective on world events http://www.ft.com/world For more video content from the Financial Times, visit http://www.FT.com/video Subscribe to the Financial Times on YouTube; http://goo.gl/vUQx5k Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

Is US stocks' recovery sustainable?

Is US stocks' recovery sustainable?Is US stocks' recovery sustainable?

Reporting from New York, John Authers will spend the next two weeks exploring whether the recovery of US markets in sustainable - or whether, as many fear, it is simply a symptom of stimulus from the Federal Reserve. For more video content from the Financial Times, visit http://www.FT.com/video Subscribe to the Financial Times on YouTube; http://goo.gl/vUQx5k Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

US Stocks are the Inflation Hedge! Not Silver & Gold. Japan is BUYING STOCKS!!!

US Stocks are the Inflation Hedge! Not Silver & Gold. Japan is BUYING STOCKS!!!US Stocks are the Inflation Hedge! Not Silver & Gold. Japan is BUYING STOCKS!!!

Daily Newsletter on investing, the economy, inflation and how to Profit in today's market. --7 Day money back guarantee-- *Turbo-Mini Portfolio +84.1% since 1/1/13, LIVE trades, only 5 stocks** Easy to follow. Diversify today! -

U.S. Consumers To Be Big Gold Buyers, Mining Stocks May Turnaround - Frank Holmes

U.S. Consumers To Be Big Gold Buyers, Mining Stocks May Turnaround - Frank HolmesU.S. Consumers To Be Big Gold Buyers, Mining Stocks May Turnaround - Frank Holmes

In a special edition Gold Game film, Kitco News talks to Frank Holmes about his expectations for 2015. He said that he is expecting physical gold demand to remain strong heading into 2015 as consumers save money on cheaper gasoline prices. “This year you are going to see the U.S. being a big buyer of gold, particularly of jewelry,” he said. Along with the U.S. Holmes said he expects to see strong demand in China heading into the Lunar New Year, which is in February. Holmes adds that he also sees central bank remain gold buyers in 2015. Holmes added that higher gold and commodity prices are needed for mining stocks to turn around in 2015. Tune -

Why Could Billionaires Be Dumping US Stocks

Why Could Billionaires Be Dumping US StocksWhy Could Billionaires Be Dumping US Stocks

http://www.moneynews.com/MKTNews/billionaires-dump-economist-stock/2012/08/29/id/450265?PROMO_CODE=110D8-1&utm;_source=taboola Despite the 6.5% stock market r... -

U.S. stocks stumble, Oil falls to five year lows- 50 pound bags of flour a better investment

U.S. stocks stumble, Oil falls to five year lows- 50 pound bags of flour a better investmentU.S. stocks stumble, Oil falls to five year lows- 50 pound bags of flour a better investment

www.marygreeley.com/ U.S. stocks stumble, Oil falls to five year lows- 50 pound bags of flour a better investment http://uk.reuters.com/article/2014/12/08/uk-markets-global-idUKKBN0JM01920141208 "Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use." § 107.Limitations on exclusive rights: Fair use Notwithstanding the provisions of sections 106 -

STOCK MARKET CRASH - US Stocks Plunge, Wiping Out July's Gains

STOCK MARKET CRASH - US Stocks Plunge, Wiping Out July's GainsSTOCK MARKET CRASH - US Stocks Plunge, Wiping Out July's Gains

SUBSCRIBE to ELITE NWO AGENDA for Latest on DOLLAR COLLAPSE / STOCK MARKET CRASH / GLOBAL RESET / GOLD / SILVER http://www.youtube.com/EliteNWOAgenda STOCK M... -

Investment advisor Bill Gunderson: U.S. stocks have dominated world market, but what about 2015?

Investment advisor Bill Gunderson: U.S. stocks have dominated world market, but what about 2015?Investment advisor Bill Gunderson: U.S. stocks have dominated world market, but what about 2015?

Investment advisor Bill Gunderson: U.S. stocks have dominated world market, but what about 2015? Click here for a FREE Trial Subscription to the Best Stocks Now newsletter. http://pwstreet.com/newsletter/ Get a Free subscription to the Best Stocks Now app. Just click here. http://pwstreet.com/app/ Bill Gunderson is a fee-based financial advisor, wealth manager and creator of the Best Stocks Now app. He is the president of Gunderson Capital Management, with offices in downtown San Diego. He manages a portfolio of over $100 million with clients from all over the country. He is a member of the Scottrade Advisory Council, composed -

US Market Close 6 Mar 15: US stocks record slight gains ahead of non-farm payrolls data

US Market Close 6 Mar 15: US stocks record slight gains ahead of non-farm payrolls dataUS Market Close 6 Mar 15: US stocks record slight gains ahead of non-farm payrolls data

Wall Street ends choppy session in positive territory ahead of Friday’s employment report. Overnight, the ECB announced a trillion-dollar plan to buy government bonds and other debt. -

TrimTabs' Biderman Interview on U.S. Stocks, Economy

TrimTabs' Biderman Interview on U.S. Stocks, EconomyTrimTabs' Biderman Interview on U.S. Stocks, Economy

Dec. 28 (Bloomberg) -- Charles Biderman, chief executive officer at TrimTabs Investment Research, talks about the U.S. economy, stock market and investment s... -

Current market conditions in US stocks 10/15/14

Current market conditions in US stocks 10/15/14Current market conditions in US stocks 10/15/14

A look at current market conditions, risks, and some possible trade setups, focusing primarily on US stocks. -

US Close 2 Dec 14: US stocks weaker but oil and gold higher.

US Close 2 Dec 14: US stocks weaker but oil and gold higher.US Close 2 Dec 14: US stocks weaker but oil and gold higher.

US sharemarkets fell at the open of trade but promptly rebounded. Higher gold and oil prices led to a recovery in resource stocks. The latest economic data comforted investors. But shares in Apple fell by 3.3%, weighing on the technology sector. -

Jim Rogers: Not a Good Time to Buy US Stocks, Gold & Crude Oil Going Much Higher

Jim Rogers: Not a Good Time to Buy US Stocks, Gold & Crude Oil Going Much HigherJim Rogers: Not a Good Time to Buy US Stocks, Gold & Crude Oil Going Much Higher

Jim Interview on Business Insider - 9th of May 2012 Blog Post: http://etf-investment-ideas.blogspot.com/2012/05/jim-rogers-not-good-time-to-buy-stock.html. -

US Close 10 Feb 15: Euro & US stocks lower overnight as oil rise and pressure mounts on Greece.

US Close 10 Feb 15: Euro & US stocks lower overnight as oil rise and pressure mounts on Greece.US Close 10 Feb 15: Euro & US stocks lower overnight as oil rise and pressure mounts on Greece.

US sharemarkets fell on Monday. Increased tensions over Greek debt and weaker Chinese trade data were the main drivers. The lift in the oil price helped curtail the losses for the broader market, with the S&P; energy index rising by 0.2%. …… Visit CommSec http://www.commsec.com.au Follow Us On Twitter http://www.twitter.com/commsec Subscribe to CommSecTV http://youtube.com/subscription_center?add_user=commsectv Discuss the market in the CommSec Community. Log into your CommSec account, click on Community and Join In. -

Fee-based financial advisor Bill Gunderson: Are U.S. stocks still the best place to be?

Fee-based financial advisor Bill Gunderson: Are U.S. stocks still the best place to be?Fee-based financial advisor Bill Gunderson: Are U.S. stocks still the best place to be?

Fee-based financial advisor Bill Gunderson: Are U.S. stocks still the best place to be? Bill Gunderson is a fee-based financial advisor, wealth manager and creator of the Best Stocks Now app. He is the president of Gunderson Capital Management, with offices in downtown San Diego. He manages a portfolio of over $100 million with clients from all over the country. He is a member of the Scottrade Advisory Council, composed to top financial advisors and money managers from around the country. “Before I buy a stock I want to see three things,” Gunderson said. “Value, performance, and healthy stock chart. We follow 3900 stocks. And we only inv -

Dorsey Report: Feds + Earnings to Boost US Stocks, Bonds

Dorsey Report: Feds + Earnings to Boost US Stocks, BondsDorsey Report: Feds + Earnings to Boost US Stocks, Bonds

For the full report get a Silver or Gold subscription here: http://bit.ly/14wD2r7 Let me know what you think of the show: http://bit.ly/1y5bxBR -

Canonical sectors and evolution of US stocks - RICKY CHACHRA

Canonical sectors and evolution of US stocks - RICKY CHACHRACanonical sectors and evolution of US stocks - RICKY CHACHRA

An unsupervised machine learning algorithm to exploit the underlying data structure in historical stock market returns shows promising classification results with implications for macroeconomic analysis and for creating financial indices.

- Duration: 0:49

- Updated: 24 Mar 2015

- published: 24 Mar 2015

- views: 2

- Duration: 8:47

- Updated: 11 Mar 2015

- published: 11 Mar 2015

- views: 408

- Duration: 7:50

- Updated: 01 Sep 2014

- author: Meir Barak

- published: 14 Mar 2014

- views: 3157

- author: Meir Barak

- Duration: 7:44

- Updated: 01 Oct 2014

- published: 01 Oct 2014

- views: 49

- Duration: 2:06

- Updated: 10 Feb 2015

- published: 10 Feb 2015

- views: 184

- Duration: 0:48

- Updated: 20 Mar 2015

- published: 20 Mar 2015

- views: 4

- Duration: 1:05

- Updated: 25 Feb 2015

- published: 25 Feb 2015

- views: 181

- Duration: 3:22

- Updated: 12 Nov 2013

- published: 12 Nov 2013

- views: 45

- Duration: 8:56

- Updated: 31 Oct 2014

- published: 31 Oct 2014

- views: 2818

- Duration: 7:39

- Updated: 15 Dec 2014

- published: 15 Dec 2014

- views: 193

- Duration: 42:04

- Updated: 25 Aug 2014

- author: Corbey McCoy

- published: 21 May 2013

- views: 4224

- author: Corbey McCoy

- Duration: 3:24

- Updated: 08 Dec 2014

- published: 08 Dec 2014

- views: 265

- Duration: 1:00

- Updated: 08 Aug 2014

- author: Elite NWO Agenda

- published: 02 Aug 2014

- views: 1792

- author: Elite NWO Agenda

- Duration: 10:46

- Updated: 08 Dec 2014

- published: 08 Dec 2014

- views: 66

- Duration: 1:53

- Updated: 05 Mar 2015

- published: 05 Mar 2015

- views: 70

- Duration: 12:52

- Updated: 02 Dec 2011

- author: TrimTabs

- published: 30 Dec 2010

- views: 1125

- author: TrimTabs

- Duration: 6:25

- Updated: 15 Oct 2014

- published: 15 Oct 2014

- views: 19

- Duration: 1:55

- Updated: 01 Dec 2014

- published: 01 Dec 2014

- views: 294

- Duration: 4:07

- Updated: 18 May 2014

- author: etfideas

- published: 10 May 2012

- views: 7673

- author: etfideas

- Duration: 1:54

- Updated: 09 Feb 2015

- published: 09 Feb 2015

- views: 71

- Duration: 10:55

- Updated: 01 Dec 2014

- published: 01 Dec 2014

- views: 46

- Duration: 10:27

- Updated: 12 Jan 2015

- published: 12 Jan 2015

- views: 53

- Duration: 36:20

- Updated: 17 Sep 2014

- published: 17 Sep 2014

- views: 10

-

Interview mit Marc Faber: Dollar wird wahrscheinlich weiter steigen

Interview mit Marc Faber: Dollar wird wahrscheinlich weiter steigenInterview mit Marc Faber: Dollar wird wahrscheinlich weiter steigen

Interview mit Marc Faber, dem Herausgeber und Autor von "The Gloom, Boom & Doom Report" www.gloomboomdoom.com Abonnieren Sie meinen Kanal und geben Sie mir einen Daumen hoch, wenn Ihnen das Interview gefallen hat! Meinen Trading-Desktop können Sie im Internet einsehen. Surfen Sie auf Guidants: http://go.guidants.com/de#c/jochen.stanzl -

Raw Uncut Footage of Marc Faber Home Interview | Squawkonomics | |

Raw Uncut Footage of Marc Faber Home Interview | Squawkonomics | |Raw Uncut Footage of Marc Faber Home Interview | Squawkonomics | |

Raw uncut footage of a Squawkonomics Home Interview with investment legend Dr. Marc Faber. Dr. Faber discussed with Keith Hilden of Squawkonomics about Bitco... -

Marc Faber: Stock market could crash this year- CNBC Interview April 2014

Marc Faber: Stock market could crash this year- CNBC Interview April 2014Marc Faber: Stock market could crash this year- CNBC Interview April 2014

US has outperformed Emerging Markets and it is too late to buy the US Stocks and why the stock market could crash later this year 2014. -

GSR interviews MARC FABER - March 4, 2015

GSR interviews MARC FABER - March 4, 2015GSR interviews MARC FABER - March 4, 2015

GoldSeek Radio's Chris Waltzek talks to analyst Marc Faber http://www.goldseek.com/ http://radio.goldseek.com/ -

The Bubble - Raw footage of Marc Faber interview

The Bubble - Raw footage of Marc Faber interviewThe Bubble - Raw footage of Marc Faber interview

Raw footage of Marc Faber interview from The Bubble. -

The Bubble Raw footage of Marc Faber interview

The Bubble Raw footage of Marc Faber interviewThe Bubble Raw footage of Marc Faber interview

Raw footage of Marc Faber interview from The Bubble. MARC FABER interview The Bubble Raw footage SUBSCRIBE for Latest on ECONOMIC AGENDA FINANCIAL CRISIS / FINANCIAL MELTDOWN / WW3 / DOLLAR COLLAPSE / GOLD / SI. Title says it all basically. MARC FABER interview The Bubble Raw footage SUBSCRIBE for Latest on ECONOMIC AGENDA FINANCIAL CRISIS / FINANCIAL MELTDOWN / WW3 / DOLLAR COLLAPSE . Raw uncut footage of a Squawkonomics Home Interview with investment legend Dr. Marc Faber. Dr. Faber discussed with Keith Hilden of Squawkonomics about Bitco. -

Ep. 223: Marc Faber Interview with Michael Covel on Trend Following Radio

Ep. 223: Marc Faber Interview with Michael Covel on Trend Following RadioEp. 223: Marc Faber Interview with Michael Covel on Trend Following Radio

Michael Covel speaks with Marc Faber, Editor and Publisher of "The Gloom, Boom & Doom Report", in person on the podcast (recorded in Chiang Mai, Thailand at Faber's office). Covel and Faber discuss the current state of Russia; changing geopolitics; Faber’s experience living through the Cold War; the difference between Crimea’s value to the west and its value to Russia; why the Russians perceived the uprising in Kiev to be financed by western power; China’s reaction to the situation in Crimea; the construction boom in China; the difficulty of forecasting China’s geopolitical changes; positive and negative valuations of the market, and finding -

Marc Faber: Gold Price, US Dollar & the Swiss Gold Initiative

Marc Faber: Gold Price, US Dollar & the Swiss Gold InitiativeMarc Faber: Gold Price, US Dollar & the Swiss Gold Initiative

https://www.goldbroker.com/news/marc-faber-gold-us-dollar-china-swiss-gold-referendum-649 Dan Popescu exclusive interview with Marc Faber (economist and market forecaster, Gloomboomdoom.com) on gold, the US dollar, China and the Swiss gold Referendum. - Is the US dollar coming out of a major bear market started in 1995? http://youtu.be/Dp1VjMal6Tc?t=45s - Is it possible for gold to go under $1,000? http://youtu.be/Dp1VjMal6Tc?t=1m57s - Could Russia and other emerging market central banks sell gold? http://youtu.be/Dp1VjMal6Tc?t=3m38s - Is the US dollar in a new major bull market? http://youtu.be/Dp1VjMal6Tc?t=5m - How will the Swiss gold ref -

Total Economic Collapse, Death of the Dollar, Impovershment, WWIII, Marc Faber Interview

Total Economic Collapse, Death of the Dollar, Impovershment, WWIII, Marc Faber InterviewTotal Economic Collapse, Death of the Dollar, Impovershment, WWIII, Marc Faber Interview

Learn how to survive the upcoming economic collapse at: http://www.chiworldwide.org ABOUT MARC FABER Dr Marc Faber was born in Zurich, Switzerland. He went t... -

Marc Faber McAlvany Interview 23 February 2011.

Marc Faber McAlvany Interview 23 February 2011.Marc Faber McAlvany Interview 23 February 2011.

http://faber-blog.blogspot.com/ for details Interview with Dr. Marc Faber: Measuring with the Proper Unit of Account...Gold A Look At This Week's Show: - Ger... -

Marc Faber Interview Part 1 - Money printing doesn't help the average person

Marc Faber Interview Part 1 - Money printing doesn't help the average personMarc Faber Interview Part 1 - Money printing doesn't help the average person

http://www.futuremoneytrends.com/index.php/interviews/176-marc-faber-interivew. -

Marc Faber interview The Bubble Raw footage

Marc Faber interview The Bubble Raw footageMarc Faber interview The Bubble Raw footage

Jim Rogers, Chris Waltzek, Peter Spina, Gold Seek Radio, Gold, Silver, Precious Metals, Economic Crisis, Economy, Collapse, Dollar, Federal Reserve Bank 2015 -

[290] Marc Faber: Is gold making a return in the new year?

[290] Marc Faber: Is gold making a return in the new year?[290] Marc Faber: Is gold making a return in the new year?

During times of turmoil, people tend to pile into to safe haven assets. And many people’s favorite safe haven asset always has been and always will be gold, which is having a mixed year. Global demand for gold has hit a four-year low. However, thanks to turmoil in the Eurozone, gold has bounced back more than 3% this year after falling 28% the previous two years. Erin weighs in. Then, Erin sits down with Marc Faber – editor and publisher of the Gloom, Boom & Doom Report and director of Marc Faber Ltd. Marc tell us what he why he believes this is the year that people will lose confidence in central banks. He also gives his usual nod to buyi -

Marc Faber im Exklusiv-Interview: Es riecht nach Crash! (1/2

Marc Faber im Exklusiv-Interview: Es riecht nach Crash! (1/2Marc Faber im Exklusiv-Interview: Es riecht nach Crash! (1/2

In den letzten Wochen hat der Schweizer Starinvestor Marc Faber mehrmals davor gewarnt, dass ihn die momentane Situation an den Aktienmärkten stark an das Cr... -

Marc Faber May Interview - MARKET COLLAPSE & GOLD CRASH Explained

Marc Faber May Interview - MARKET COLLAPSE & GOLD CRASH ExplainedMarc Faber May Interview - MARKET COLLAPSE & GOLD CRASH Explained

Marc Faber believes the markets are set for a correction this summer. He continues to stack gold every month, buying into the correction. Visit http://DailyS... -

Michael Campbell interviews Marc Faber July 5 2014

Michael Campbell interviews Marc Faber July 5 2014Michael Campbell interviews Marc Faber July 5 2014

Michael Campbell interviews Marc Faber July 5 2014. For more information, go to Moneytalks.net. -

An Exclusive In Depth Interview With Dr. Marc Faber

An Exclusive In Depth Interview With Dr. Marc FaberAn Exclusive In Depth Interview With Dr. Marc Faber

We Talk About The Markets, Economy, Bitcoin And More! Dr. Marc Faber is a Swiss investor. Faber is publisher of the Gloom Boom & Doom Report newsletter and i... -

Interview (10.02.2009) mit Marc Faber und Max Otte über Ursachen und Folgen der Finanzkrise

Interview (10.02.2009) mit Marc Faber und Max Otte über Ursachen und Folgen der FinanzkriseInterview (10.02.2009) mit Marc Faber und Max Otte über Ursachen und Folgen der Finanzkrise

Interview über Ursachen und Folgen der Finanzkrise. Themen: * expansive Geldpolitik (Kreditwachstum) als Ursache der Blasenbildung * die Unverantwortlichkeit... -

Jim Rogers Interviews Marc Faber

Jim Rogers Interviews Marc FaberJim Rogers Interviews Marc Faber

For the latest Jim Rogers, go to http://JimRogersBlog.com - Here is a rare video of Jim Rogers and Marc Faber together. You may not understand the introduction to the video, but the bulk of it is in English. From the perspective across the Atlantic, is this new plan going to work? 25 countries, which are very different are all coming together. The hope is that this will bring centuries of peace. Bringing in 9 new languages and people with no infrastructure seems like a stretch to say that this will help the EU. In the US, people don't understand history or anything that happens outside of their country. This is the first time that so ma -

Marc Faber Interview on Chinese Yuan, Gold Prices

Marc Faber Interview on Chinese Yuan, Gold PricesMarc Faber Interview on Chinese Yuan, Gold Prices

Faber Interview on Chinese Yuan, Gold Prices, Stocks Sept. 24 -- Marc Faber, publisher of the Gloom, Boom & Doom report, discusses the outlook for the Chines... -

Marc Faber: Bloomberg Interview May 25, 2010 Part 2

Marc Faber: Bloomberg Interview May 25, 2010 Part 2Marc Faber: Bloomberg Interview May 25, 2010 Part 2

http://www.marcfaberreport.com. -

Economist Marc Faber Interview on Gold Silver

Economist Marc Faber Interview on Gold SilverEconomist Marc Faber Interview on Gold Silver

economy 2013,2014 economy,financial,gold, gold price, 2014 gold, 2014 gold price, gold 2014, gold price 2014, silver price 2014, 2014 silver price, silver, s... -

Marc Faber : Interview with Michael Covel on Trend Following Radio

Marc Faber : Interview with Michael Covel on Trend Following RadioMarc Faber : Interview with Michael Covel on Trend Following Radio

Marc Faber : Interview with Michael Covel on Trend Following Radio Subscribe to my channel to learn all about GLOBAL FINANCIAL WAR GAMES / US DOLLAR COLLAPSE / ECONOMIC COLLAPSE / NEW WORLD ORDER / FINANCIAL CRISIS / ECONOMIC FUTURE

- Duration: 36:32

- Updated: 07 Oct 2014

- published: 07 Oct 2014

- views: 2410

- Duration: 39:04

- Updated: 05 Sep 2014

- author: Squawkonomics

- published: 31 Aug 2014

- views: 670

- author: Squawkonomics

- Duration: 3:13

- Updated: 06 Jul 2014

- author: Marc Faber Blog

- published: 30 Apr 2014

- views: 4139

- author: Marc Faber Blog

- Duration: 28:28

- Updated: 06 Mar 2015

- published: 06 Mar 2015

- views: 5431

- Duration: 50:39

- Updated: 18 Aug 2014

- author: TheBubbleFilm

- published: 26 Nov 2012

- views: 77476

- author: TheBubbleFilm

- Duration: 136:07

- Updated: 22 Dec 2014

- published: 22 Dec 2014

- views: 278

- Duration: 57:26

- Updated: 01 Oct 2014

- published: 01 Oct 2014

- views: 8

- Duration: 16:59

- Updated: 13 Nov 2014

- published: 13 Nov 2014

- views: 858

- Duration: 2:30

- Updated: 22 Jun 2013

- author: CHIWorldWide

- published: 15 Feb 2012

- views: 10616

- author: CHIWorldWide

- Duration: 38:56

- Updated: 23 Nov 2013

- author: Gordon Silverstein

- published: 21 Apr 2012

- views: 32133

- author: Gordon Silverstein

- Duration: 10:18

- Updated: 17 Jun 2014

- author: FutureMoneyTrends

- published: 24 May 2014

- views: 2382

- author: FutureMoneyTrends

- Duration: 131:24

- Updated: 16 Feb 2015

- published: 16 Feb 2015

- views: 5

![[290] Marc Faber: Is gold making a return in the new year? [290] Marc Faber: Is gold making a return in the new year?](http://web.archive.org./web/20150420211724im_/http://i.ytimg.com/vi/lWzZmiN-Cic/0.jpg)

- Duration: 27:53

- Updated: 13 Feb 2015

- published: 13 Feb 2015

- views: 19124

- Duration: 15:48

- Updated: 10 Feb 2014

- author: DAFChannel

- published: 23 Aug 2013

- views: 5661

- author: DAFChannel

- Duration: 2:55

- Updated: 01 Feb 2014

- author: SilverCoinNews

- published: 11 May 2013

- views: 10317

- author: SilverCoinNews

- Duration: 20:12

- Updated: 26 Aug 2014

- author: Money Talks

- published: 06 Jul 2014

- views: 1524

- author: Money Talks

- Duration: 30:14

- Updated: 04 Aug 2014

- author: WorldTravelerMan

- published: 16 May 2014

- views: 5623

- author: WorldTravelerMan

- Duration: 9:07

- Updated: 18 May 2014

- author: Krisenmanager

- published: 13 Feb 2009

- views: 34481

- author: Krisenmanager

- Duration: 10:10

- Updated: 11 May 2011

- published: 11 May 2011

- views: 21048

- Duration: 6:36

- Updated: 10 Apr 2014

- author: TheSilverGuild

- published: 25 Sep 2010

- views: 9766

- author: TheSilverGuild

- Duration: 5:57

- Updated: 20 Jan 2014

- author: marcfaberreport

- Duration: 8:45

- Updated: 22 Mar 2014

- author: ABCNewsUS

- published: 24 Jun 2013

- views: 340

- author: ABCNewsUS

- Duration: 57:26

- Updated: 11 Jan 2015

- published: 11 Jan 2015

- views: 1

-

Ep 61: Dollar Strength Defies U.S. Economic and Stock Market Weakness

Ep 61: Dollar Strength Defies U.S. Economic and Stock Market WeaknessEp 61: Dollar Strength Defies U.S. Economic and Stock Market Weakness

The Peter Schiff Show Podcast - Episode 61 http://www.USTaxFreeZone.com SIGN UP FOR MY FREE NEWSLETTER: http://www.europac.net/subscribe_free_reports -

U.S., China, Greece, Stocks all Tumble as Crude Collapses to New Lows

U.S., China, Greece, Stocks all Tumble as Crude Collapses to New LowsU.S., China, Greece, Stocks all Tumble as Crude Collapses to New Lows

Are we looking at a world economic global collapse? Here is some headlines and the broadcast that breaks it down. The Shemitah continues... Please forward. http://www.usatoday.com/story/money/markets/2015/01/30/stocks-friday/22579609/ http://www.businessinsider.com/crude-oil-breaks-44-a-barrel-2015-1 http://www.independent.co.uk/news/business/news/greek-stocks-fall-by-22-as-athens-market-tumbles-for-the-third-consecutive-day-10008720.html http://www.bloomberg.com/news/articles/2015-01-29/china-s-stock-index-futures-drop-as-csrc-starts-new-margin-probe http://www.zerohedge.com/news/2015-01-28/chinese-stocks-drop-3rd-day-row-yuan-tumbles-recor -

Is A Bear Market Possible In US Stocks In The Era of Endless Liquidity - November 4, 2014

Is A Bear Market Possible In US Stocks In The Era of Endless Liquidity - November 4, 2014Is A Bear Market Possible In US Stocks In The Era of Endless Liquidity - November 4, 2014

This video was originally published for Radio Free Wall Street subscribers on November 4, 2014. To see the latest videos in real time, subscribe at http://radiofreewallstreet.fm. Go behind the paper curtain of Wall Street propaganda and get the facts. -

Trading Video: US Dollar and Stocks Follow the Path of Least Resistance

Trading Video: US Dollar and Stocks Follow the Path of Least ResistanceTrading Video: US Dollar and Stocks Follow the Path of Least Resistance

Talking Points: • If we were to take the S&P; 500's move at face value, it would seem there was strong risk appetite Monday • Demand for 'riskier' assets was uneven Monday and even the S&P; 500's run lacked depth • The Dollar would also follow the lower boundary move while the Euro played aloof to growing risks Read the full article here: http://www.dailyfx.com/forex/video/daily_news_report/2015/03/31/Trading-Video-US-Dollar-and-Stocks-Follow-the-Path-of-Least-Resistance.html?CMP=SFS-70160000000NbUQAA0 -

S&P; 500 Market Update: US Stocks Fall S&P; Worst Weekly Drop in 2012

S&P; 500 Market Update: US Stocks Fall S&P; Worst Weekly Drop in 2012S&P; 500 Market Update: US Stocks Fall S&P; Worst Weekly Drop in 2012

http://www.StockMarketFunding.com US Stocks Fall as S&P; 500 Has Worst Weekly Drop in 2012. Stock Futures are gapping down due to the March jobs report report disappoints. The March jobs report was a disappointment: Only 120,000 new jobs were created, versus expectations of over 200,000 and the unemployment rate dropped to 8.2 percent from 8.3 percent in February, leaving 12.7 Americans still out of work. Given the three previous' months results, where job creation averaged 246,000 per month, this report is a setback to the nation's labor market. We told traders how the "Market Top" set up in 2-4 weeks and to expect a correction in this -

Is US.Dollar Decoupling From Stocks While Gold Still Smelts Ponders Oscar Carboni 02/06/2015 #1279

Is US.Dollar Decoupling From Stocks While Gold Still Smelts Ponders Oscar Carboni 02/06/2015 #1279Is US.Dollar Decoupling From Stocks While Gold Still Smelts Ponders Oscar Carboni 02/06/2015 #1279

Visit our Website: http://www.LiveWithOscar.com TV INTERVIEWS: http://livewithoscar.com/media.aspx Follow Us on Twitter: http://www.Twitter.com/livewithoscar Add us on Facebook: http://www.facebook.com/profile.php?id=1216243730 Upload your charts to: http://www.ChartUpload.com Tags: futures options broker online trading managed CTA charts commodities commodity daytrading forex software simulated electronic free oscar live with omni bull bear finance economy bernanke cramer cnbc bloomberg fed buffett financial wall st business cbot nymex nybot comex sec securities etrade scottrade account currencies etf stocks emini s&p; fx nasdaq nq qqqq -

[71] Paul Craig Roberts on the Bubble in Bonds, Stocks and the US Dollar

[71] Paul Craig Roberts on the Bubble in Bonds, Stocks and the US Dollar[71] Paul Craig Roberts on the Bubble in Bonds, Stocks and the US Dollar

check us out on Facebook http://www.facebook.com/PrimeInterest Follow us @ http://twitter.com/EnglishPI http://twitter.com/PerianneRT Here's what's in your Prime Interest today: Don't fight the Fed! So the mantra goes. Today, a twenty-two year old Bangladeshi man was sentenced to thirty years for attempting to blow up the New York Federal Reserve building. His fledgling terrorist cell was infiltrated by the FBI, which supplied him with one thousand pounds of fake explosives. According to the Justice Department, the attempted bomber asserted the plan was his own -- and that his goal was to "destroy America" by targeting its economy. -

'Bitcoin outperforms gold, silver, US stock market' - entrepreneur

'Bitcoin outperforms gold, silver, US stock market' - entrepreneur'Bitcoin outperforms gold, silver, US stock market' - entrepreneur

Bitcoin is the world's most popular virtual currency, and brings with it a new breed of digital multi-millionaires. When bitcoin exchange Mt. Gox virtually d... -

Early Edition 18:00 U.S. stocks suffer worst drop since June after weaker-than-expected data

Early Edition 18:00 U.S. stocks suffer worst drop since June after weaker-than-expected dataEarly Edition 18:00 U.S. stocks suffer worst drop since June after weaker-than-expected data

Title: U.S. stocks suffer worst drop since June after weaker-than-expected data It might be time to buckle up... as Asian markets, including Korea's benchmark KOSPI, are bracing for heavy losses after stocks on Wall Street plunged more than two percent on Monday. It was the biggest fall since June as worries over U.S. and global growth continue to mount. Our Yoo Li-an reports. Fresh concerns about the strength of the global economy on the back of weaker-than-expected data out of the United States and China,... sent stocks tumbling on Tuesday. Taking a cue from overnight losses on Wall Street,... the Korean KOSPI closed below the 19-hundred m -

Gold, Silver Spike as U.S. Stocks Slump - Jerry Robinson

Gold, Silver Spike as U.S. Stocks Slump - Jerry RobinsonGold, Silver Spike as U.S. Stocks Slump - Jerry Robinson

Jerry Robinson comments on the latest economic headlines and is joined by John Rubino from DollarCollapse.com to discuss the latest on the Federal Reserve. -

Index Investing Show - "US stocks aren't bothered by the blood in other people's streets..."

Index Investing Show - "US stocks aren't bothered by the blood in other people's streets..."Index Investing Show - "US stocks aren't bothered by the blood in other people's streets..."

Aired on 2/23/14 - Topics discussed by Host, Ron DeLegge: 1) The world is burning! and the S&P; 500, Nasdaq, and Dow don't care 2) Are corporate earnings being gamed? 3) GUEST: Mike Eschmann, w/ Direxion Funds 4) Ron's MARCH 2014 ETF Profit Strategy Newsletter is OUT! (Use promo code TRADEUP to save $50 @ http://www.ETFguide.com) Follow us on Twitter @IndexShow, visit us at http://www.youtube.com/user/IndexInvestingShow -

Stock Market Tutorial - The Only Video You'll Ever Need

Stock Market Tutorial - The Only Video You'll Ever NeedStock Market Tutorial - The Only Video You'll Ever Need

Buy My Book - http://goo.gl/d0Nv0Z EpicStockDD Store - http://EpicStockDD.logosoftwear.com/ Epic Stock Due Diligence ("EpicStockDD") ALL VIDEOS AND COMMENTS ARE FOR ENTERTAINMENT PURPOSES ONLY. THEY SHOULD NOT BE CONSIDERED A RECOMMENDATION TO BUY OR SELL A SECURITY. INVESTING INVOLVES EXTREME RISK. Welcome to Epic Stock Due Diligence (http://youtube.com/EpicStockDD)! I wanted to create a source for stock market how-to information. The stock market is a fascinating adventure but can seem overwhelming at times. Within this channel, I will post a plethora of stock market tutorial videos. If I don't have a video on a topic of interest -

PRIME TIME NEWS 22:00 U.S. stocks suffer worst drop since June after weaker-than-expected data

PRIME TIME NEWS 22:00 U.S. stocks suffer worst drop since June after weaker-than-expected dataPRIME TIME NEWS 22:00 U.S. stocks suffer worst drop since June after weaker-than-expected data

Title: U.S. stocks suffer worst drop since June after weaker-than-expected data We begin this evening on the financial front..., Asian markets, including Korea's benchmark KOSPI..., are bracing for heavy losses... after stocks on Wall Street plunged more than two percent on Monday. It was the biggest fall since June... as worries over U.S. and global growth continue to mount. Our Yoo Li-an starts us off. Fresh concerns about the strength of the global economy on the back of weaker-than-expected data out of the United States and China,... sent stocks tumbling on Tuesday. Taking a cue from overnight losses on Wall Street,... the Korean KOSPI -

US Market Technical Review - A 'Last Hurrah' Melt-Up For Stocks? (Sep. 13, 2013)

US Market Technical Review - A 'Last Hurrah' Melt-Up For Stocks? (Sep. 13, 2013)US Market Technical Review - A 'Last Hurrah' Melt-Up For Stocks? (Sep. 13, 2013)

Why turn bearish on the SPX when there has been zero technical evidence to support a bearish downtrend since July 2011?. Why?. That downtrend move actually e... -

Stock Market Plunge Live Trading Stocks Fall 3%, Dow Down 360: U.S. Join World Sell-Off

Stock Market Plunge Live Trading Stocks Fall 3%, Dow Down 360: U.S. Join World Sell-OffStock Market Plunge Live Trading Stocks Fall 3%, Dow Down 360: U.S. Join World Sell-Off

http://www.StockMarketFunding.com Stock Market Plunge Live Trading Stocks Fall 3%, Dow Down 360: U.S. Join World Sell-Off. Stocks moved sharply lower at the start of trading on Thursday, extending the substantial downward move seen in the previous session. The major averages all slid firmly into negative territory, with the Dow dropping to its lowest intraday level in a month. In the past few minutes, the major averages have seen some further downside, hitting new lows for the young session. The Dow is down 356.46 points or 3.2 percent at 10,768.38, the Nasdaq is down 76.15 points or 3 percent at 2,462.04 and the S&P; 500 is down 35.60 p -

ARIRANG NEWS 10:00 U.S. stocks suffer worst drop since June after weaker-than-expected data

ARIRANG NEWS 10:00 U.S. stocks suffer worst drop since June after weaker-than-expected dataARIRANG NEWS 10:00 U.S. stocks suffer worst drop since June after weaker-than-expected data

-

ECONOMIC COLLAPSE: American Crisis! Stocks are Falling, US Dollar and Treasuries Rise! 5-16-2011

ECONOMIC COLLAPSE: American Crisis! Stocks are Falling, US Dollar and Treasuries Rise! 5-16-2011ECONOMIC COLLAPSE: American Crisis! Stocks are Falling, US Dollar and Treasuries Rise! 5-16-2011

Stock Market Trading and Economic forecast using common sense analysis and decision making techniques. Focus is on the U.S. Dollar, Commodities (CRB Index), Bonds (10 Yr. Treasuries), and the Stock Market (DJIA 30). Gold, silver and oil are often discussed when relating to commodities. Stocks discussed this week include: El Paso Pipeline, Polypore International, Edwards Lifescience, Altera Corp, and Tempur Pedic. Each week the worst stock is sold and a new stock is added! -

Stock Exchange - Documentary Films

Stock Exchange - Documentary FilmsStock Exchange - Documentary Films

Stock Exchange - Documentary Films. A stock exchange is a form of exchange which provides services for stock brokers and traders to buy or sell stocks, bonds, and other securities. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets, with buyers and sellers consummating transactions at a central location, such as t -

Learn How to Profit Trading Biotech Stocks 2014 BIIB CELG REGN GILD VRTX IBB UTHR INSY OMED TECH

Learn How to Profit Trading Biotech Stocks 2014 BIIB CELG REGN GILD VRTX IBB UTHR INSY OMED TECHLearn How to Profit Trading Biotech Stocks 2014 BIIB CELG REGN GILD VRTX IBB UTHR INSY OMED TECH

http://www.StockMarketFunding.com Learn How to Profit Trading Biotech Stocks 2014 (VIDEO). NASDAQ Biotechnology Index Commentary & Biotech Stock to Watch (VIDEO). We'll cover detailed technical analysis trends on the Nasdaq Biotechnology Index which has been on fire lately! We'll cover key technical analysis trends and how to trade shares of Biogen Idec (BIIB), REGN, CELG, Gilead Sciences (GILD), Intercept Pharmaceuticals, Inc. (ICPT), Jazz Pharmaceuticals (JAZZ), Vertex Pharmaceuticals (VRTX), Seattle Genetics (SGEN), United Therapeutics (UTHR), INSYS Therapeutics (INSY), OncoMed Pharmaceuticals (OMED), Techne (TECH), PTC Therapeutics (PTC -

PM Exchange - U.S. stocks rebound, USD gains

PM Exchange - U.S. stocks rebound, USD gainsPM Exchange - U.S. stocks rebound, USD gains

Forex TV - Equities driving forex market, libor rate affects. USD gains on EUR and GBP. Wells Fargo's Serebriakov with his Fx forecast. -

Catching Home Run Stocks

Catching Home Run StocksCatching Home Run Stocks

Originally presented on 05/28/14 by Andrew Abraham For more information on MetaStock, visit http://www.metastock.com Home Run stocks are all around us. We us...

- Duration: 24:03

- Updated: 14 Mar 2015

- published: 14 Mar 2015

- views: 301

- Duration: 35:09

- Updated: 31 Jan 2015

- published: 31 Jan 2015

- views: 301

- Duration: 22:01

- Updated: 17 Jan 2015

- published: 17 Jan 2015

- views: 186

- Duration: 23:58

- Updated: 31 Mar 2015

- published: 31 Mar 2015

- views: 721

- Duration: 21:26

- Updated: 06 Apr 2012

- published: 06 Apr 2012

- views: 481

- Duration: 23:21

- Updated: 06 Feb 2015

- published: 06 Feb 2015

- views: 1934

![[71] Paul Craig Roberts on the Bubble in Bonds, Stocks and the US Dollar [71] Paul Craig Roberts on the Bubble in Bonds, Stocks and the US Dollar](http://web.archive.org./web/20150420211724im_/http://i.ytimg.com/vi/fRlFjt-VkU8/0.jpg)

- Duration: 28:02

- Updated: 09 Aug 2013

- published: 09 Aug 2013

- views: 12836

- Duration: 24:34

- Updated: 05 Sep 2014

- author: RT

- published: 06 May 2014

- views: 18160

- author: RT

- Duration: 27:02

- Updated: 04 Feb 2014

- published: 04 Feb 2014

- views: 124

- Duration: 70:11

- Updated: 07 Apr 2014

- author: FTMDaily

- published: 19 Aug 2013

- views: 181

- author: FTMDaily

- Duration: 43:02

- Updated: 04 Mar 2014

- published: 04 Mar 2014

- views: 41

- Duration: 30:01

- Updated: 02 Nov 2012

- published: 02 Nov 2012

- views: 474290

- Duration: 26:51

- Updated: 04 Feb 2014

- published: 04 Feb 2014

- views: 94

- Duration: 33:13

- Updated: 29 Jan 2014

- author: Elliott Wave Analytics

- published: 16 Sep 2013

- views: 351

- author: Elliott Wave Analytics

- Duration: 25:44

- Updated: 22 Sep 2011

- published: 22 Sep 2011

- views: 1600

- Duration: 26:04

- Updated: 04 Feb 2014

http://wn.com/ARIRANG_NEWS_10_00 U.S._stocks_suffer_worst_drop_since_June_after_weaker-than-expected_data

- published: 04 Feb 2014

- views: 54

- Duration: 20:20

- Updated: 15 May 2011

- published: 15 May 2011

- views: 1803

- Duration: 45:38

- Updated: 22 Jan 2015

- published: 22 Jan 2015

- views: 2

- Duration: 22:32

- Updated: 23 Mar 2014

- published: 23 Mar 2014

- views: 917

- Duration: 20:58

- Updated: 21 Oct 2008

- published: 21 Oct 2008

- views: 303

- Duration: 54:08

- Updated: 03 Aug 2014

- author: MetaStock

- published: 10 Jun 2014

- views: 846

- author: MetaStock

-

U.S. Markets Continued Their 3-Day Selloff at Thursday's Midday Trading

U.S. Markets Continued Their 3-Day Selloff at Thursday's Midday TradingU.S. Markets Continued Their 3-Day Selloff at Thursday's Midday Trading

U.S. stocks continued their three-day selloff at Thursday's midday trading. American Express (AXP) says it may have to cut jobs if the company cannot retain clients that could disappear as a result from losing its relationship with Costco (COST). The deal between American Express and Costco will expire next year. SanDisk (SNDK) tanked after lowering its Q1 revenue outlook. The memory chip maker warned weak demand and lower pricing for its guidance. Despite lowering its guidance, Lululemon (LULU) rose nearly 7% after beating earnings estimates. The yogawear retailer also showed an increase in same-store sales. Subscribe to TheStreetTV on YouT -

Marc Faber on US Stock Market & China GDP Growth Rate

Marc Faber on US Stock Market & China GDP Growth RateMarc Faber on US Stock Market & China GDP Growth Rate

65 Week Moving Average Chart: This week: -Stocks moving higher but NO Bargain -Manipulated mar... Dr. Marc Faber brings us up to speed on markets, and takes a look at the months ahead.... The CELESTIAL Convergence | November 14, 2012 - UNITED STATES - The markets are going to go into meltdown soon, ... Posted Jan 13, 2010 01:00pm EST After every financial crisis there's... Marc Faber on U.S. Stock Market & China GDP Growth Rate Marc Faber on Gold Stocks & Money Printing, Central Banks US Economic Crisis & Oil . Marc Faber on U.S. Stock Market & China GDP ... SUBSCRIBE to ELITE NWO AGENDA for Latest on GOLD / SILVER / U.S DOLLAR COLLAPSE -

Marc Faber on Gold Stocks & Money Printing, Central Banks

Marc Faber on Gold Stocks & Money Printing, Central BanksMarc Faber on Gold Stocks & Money Printing, Central Banks

Marc Faber on Gold Stocks & Money Printing, Central Banks US Economic Crisis & Oil Prices and Energy Wars :: Jesse Ventura Marc Faber on Gold Stocks & Money Printing, Central Banks ... SUBSCRIBE to ELITE NWO AGENDA for Latest on GOLD / SILVER / U.S DOLLAR COLLAPSE / QE / GLOBAL RESET / EBOLA / END GAME . ECONOMIC COLLAPSE: MARC FABER Gives . Marc Faber on Gold Stocks & Money Printing, Central Banks. Marc Faber on Gold Stocks & Money Printing, Central Banks SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / GLOBAL ECONOMIC COLLAPSE / AGENDA 21 / DOLLA... For the latest Marc Faber, go to - Japanese equities are inexpensive, but they -

Marc Faber on Gold Stocks & Money Printing, Central Banks

Marc Faber on Gold Stocks & Money Printing, Central BanksMarc Faber on Gold Stocks & Money Printing, Central Banks

Marc Faber on Gold Stocks & Money Printing, Central Banks US Economic Crisis & Oil Prices and Energy Wars :: Jesse Ventura Marc Faber on Gold Stocks & Money Printing, Central Banks . Marc Faber on Gold Stocks & Money Printing, Central Banks US Economic Crisis & Oil Prices and Energy Wars :: Jesse Ventura Major Financial . Dan Popescu exclusive interview with Marc Faber (economist and mark. Find out why Singapore is now one of the safest places in the world to store gold in our latest gold guide - Essential. -

How the Dow Jones Industrial Average Fared Wednesday

How the Dow Jones Industrial Average Fared WednesdayHow the Dow Jones Industrial Average Fared Wednesday

The U.S. stocks closed lower Wednesday, bringing the market further below record highs reached earlier this month. Nine of the 10 industry sectors in the Standard & Poor's 500 index fell. Energy was the only sector to rise, helped by a gain in the price of crude oil. On Wednesday: The Dow Jones industrial average lost 292.60 points, or 1.6 percent, to 17,718.54. The S&P; 500 index fell 30.45 points, or 1.5 percent, to 2,061.05. The Nasdaq composite fell 118.21 points, or 2.4 percent, to 4,876.52. For the week: The Dow is down 409.11 points, or 2.3 percent. The S&P; 500 index is down 47.05 points, or 2.2 percent. The Nasdaq is down 149.90 poin -

5 Things Everyone Will Be Talking About Today

5 Things Everyone Will Be Talking About Today5 Things Everyone Will Be Talking About Today

There's a lot going on today. Catch up fast Saudi Arabia launches strikes on Yemen, crude surges, European stocks dive. Here's your super-fast rundown of what's been happening, and what to look out for. Saudi strikes Saudi Arabia and its allies have launched air strikes on rebel targets in Yemen. The rebels took over the palace of President Abdurabuh Mansur Hadi back in January. The big problem for the wider region is that the rebels are backed by Iran and the President is backed by Saudi Arabia. The latest developments in the country are raising concerns about the prospect of a direct conflict between the two local superpowers. Oil is -

London Pre-market Session 26.3.2015

London Pre-market Session 26.3.2015London Pre-market Session 26.3.2015

Following a major drop in US durable goods orders, US stocks finished yesterday in the red sparking two consecutive days of losses. Asian stocks are mainly falling in response to weak US economic data. Foreign investment in Japanese stocks came in much lower than expected. The JPY continues to advance following Bank of Japan’s plan to expand its stimulus program. The NZD lost ground yesterday following trade balance prints coming in lower than expected, and this news is combining with the falling of Asian stocks to weaken the NZD and AUD. Crude oil has been consistently climbing over the past week and oil futures are up sharply, surpassing t -

Morning News Flash - London Session 26.03.15

Morning News Flash - London Session 26.03.15Morning News Flash - London Session 26.03.15

Hello Supertraders and welcome to our London session News Flash. In this session, we’ll summarize yesterday’s US trading day, we’ll review the Asian market’s latest incoming results, we’ll get ready for the upcoming London session, and of course, we’ll discuss the Hottest assets in the market. Let's Begin. Starting with the US market Following a major drop in Durable Goods Orders, US stocks finished yesterday’s trading day in the red, making it 2 consecutive days of losses. The S&P; 500 closed the day down 30.45 points, at 2,061.05. The US Dollar was trading below the 97 mark during yesterday's trading, with futures currently down 0.28% to -

Missing animal spirits

Missing animal spiritsMissing animal spirits

On a day when the buy-out of Kraft might have been expected to rouse Wall Street, US stocks instead had a bad day. John Authers suggests that the stock market is merely treading water, and that there is a shortage of obvious bargains. For more video content from the Financial Times, visit http://www.FT.com/video Subscribe to the Financial Times on YouTube; http://goo.gl/vUQx5k Twitter https://twitter.com/ftvideo Facebook https://www.facebook.com/financialtimes -

Street Signs: IIFL's Abhishek Sharma on pharma stocks

Street Signs: IIFL's Abhishek Sharma on pharma stocksStreet Signs: IIFL's Abhishek Sharma on pharma stocks

Pharma sector has been in focus with Sun Pharma-Ranbaxy merger and the US FDA alerts for Ipca Labs. Anuj Singhal & Ekta Batra discuss the top stocks with Abhishek Sharma, IIFL -

2015 Options Trading Education Understanding How to Trade Index Options on the S&P; 500 (SPX)

2015 Options Trading Education Understanding How to Trade Index Options on the S&P; 500 (SPX)2015 Options Trading Education Understanding How to Trade Index Options on the S&P; 500 (SPX)

http://www.StockMarketFunding.com 2015 Options Trading Education Understanding How to Trade Index Options on the S&P; 500 (SPX). In this live index options trading education video we'll cover the large drop in the S&P; 500 and how our traders were able to profit from these large declines using put options on the SPX. We're seeing 15 year highs trends all major stock market index charts. In this live stock market technical analysis trading educational video we'll cover long-term trends and how to make money day trading on the right side of the options market. Free Trial Signup http://www.stockmarketfunding.com/Free-Trading-Seminar Follow us o -

Dow Jones 2015 Huge Drop Technical Analysis & Market Commentary What You Need to Know

Dow Jones 2015 Huge Drop Technical Analysis & Market Commentary What You Need to KnowDow Jones 2015 Huge Drop Technical Analysis & Market Commentary What You Need to Know

http://www.StockMarketFunding.com Dow Jones 2015 Huge Drop Technical Analysis & Market Commentary What You Need to Know (VIDEO). Learn how to make money from huge drops in the Dow using our trading formulas we built for our traders. Today the Dow Jones Industrial Average (^DJI) closed at 17,718.54 Down 292.60 points or 1.62%. Well cover everything you need to know about today's trading action and what you need to know to protect your trading portfolio and set yourself up for April 2015. Free Trial Signup http://www.stockmarketfunding.com/Free-Trading-Seminar Follow us on Facebook: http://www.facebook.com/OnlineTradingPlatform Follow us on -

Nasdaq worst drop since April 2014 - Video - NYTimes.com

Nasdaq worst drop since April 2014 - Video - NYTimes.comNasdaq worst drop since April 2014 - Video - NYTimes.com

Nasdaq worst drop since April 2014 - Video - NYTimes.com www.nytimes.com/.../nasdaq-worst-drop-since-april-2... - U.S. stocks dropped on a slump in technology and biotech shares, sending the Nasdaq to its biggest decline in almost a year. Bobbi Rebell reports. Nasdaq worst drop since April 2014 - Yahoo News news.yahoo.com/.../nasdaq-worst-drop-since-april-21... - Watch the video Nasdaq worst drop since April 2014 on Yahoo News . U.S. stocks dropped on a slump in technology and biotech shares, sending the Nasdaq to its biggest decline in almost a year. Bobbi Rebell reports. Nasdaq worst drop since April 2014 - Yahoo Finance finance.yahoo.com/ -

US ECONOMY COLLAPSE Jesse Ventura talks about FINANCIAL COLLAPSE in the US

US ECONOMY COLLAPSE Jesse Ventura talks about FINANCIAL COLLAPSE in the USUS ECONOMY COLLAPSE Jesse Ventura talks about FINANCIAL COLLAPSE in the US

Read Online Stock Buying Bond Stock Traders Economic collapse Economy Economic Financial Simultaneously Buy Stocks Online Army JIM WILLIE China Stock market Peter schiff Jim rogers Marc faber Gerald celente Greg mannarino Greg hunter Ben swann Glenn beck Debt Derivatives FDIC -

U.S. Stocks Fell with the Nasdaq Hit the Hardest, Dow Down 292 Points

U.S. Stocks Fell with the Nasdaq Hit the Hardest, Dow Down 292 PointsU.S. Stocks Fell with the Nasdaq Hit the Hardest, Dow Down 292 Points

U.S. stocks fell for the third straight session at Wednesday's closing bell. The sell-off accelerated in mid-session and ended with the Dow dropping 292 points. Crude oil settled above $49 a barrel. Concerns with the turmoil in Yemen offset earlier pressure after a government report showed supplies rose more than expected. Oil giants Chevron (CVX) and Exxon Mobil (XOM) were the only blue chip gainers. Biotech stocks weighed on the Nasdaq including NewLine Genetics (NLNK) which tumbled 11%. Chipmakers also pressured the Nasdaq including Advanced Micro Devices (AMD) and Micron Technology (MU). Kraft (KRFT) was a huge gainer, up 35%. Its merger -

Closing Bell Happy Hour: March 25, 2015

Closing Bell Happy Hour: March 25, 2015Closing Bell Happy Hour: March 25, 2015

03/25/15 U.S. stocks traded in a narrow range Wednesday afternoon as investors took in a poor durable goods read and a ton of corporate news. Facebook started off its annual conference, Kraft and Heinz team up, and yes, the Islanders lost last night at the Nassau Coliseum. -

Stocks Edge Lower as Investors Assess Economy, Earnings

Stocks Edge Lower as Investors Assess Economy, EarningsStocks Edge Lower as Investors Assess Economy, Earnings

U.S. stocks moved lower in early afternoon trading Tuesday, as investors assessed the latest news on consumer prices and some company earnings. Declines were led by utilities. McCormick, a spice and seasoning company, was a top gainer after reporting better-than-expected earnings and revenue. Shares of Freeport-McMoRan fell after the mining company said it said it would slash its quarterly dividend. KEEPING SCORE: The Standard & Poor's 500 index fell five points, or 0.3 percent, to 2,099 as of 1:57 p.m. Eastern time. The Dow slipped 48 points, or 0.3 percent, to 18,068. The Nasdaq was flat at 5,011. CONSUMER PRICES: A modest rebound in gas c -

Stocks are Mostly Flat at Wednesday's Open as U.S. Dollar Stays in Focus

Stocks are Mostly Flat at Wednesday's Open as U.S. Dollar Stays in FocusStocks are Mostly Flat at Wednesday's Open as U.S. Dollar Stays in Focus

Stocks were mostly flat at Wednesday's Opening Bell as traders kept a close eye on the U.S. dollar. Durable goods orders in February dropped 1.4%, likely weighed by the strong dollar and weak global demand. Economist were expecting a modest pick-up of 0.2%. Shares of Kraft (KRFT) spiked in early trading on news it will merge with Heinz (HNZ). The combined company will form ‘Kraft Heinz’ with Heinz shareholders owning 51% and Kraft shareholders owning 49%. The deal is in part financed by Warren Buffett’s Berkshire Hathaway. Facebook’s (FB) annual developer conference kicks off today. This will be the first time the F8 conference runs for two d -

McCullough: This Is The Current Bull Case For U.S. Stocks

McCullough: This Is The Current Bull Case For U.S. StocksMcCullough: This Is The Current Bull Case For U.S. Stocks

In this brief excerpt from today’s edition of The Macro Show, Hedgeye CEO Keith McCullough explains the current bull case for equities, brought to you courtesy of our unelected policymakers at the Federal Reserve. -

US Stock Indexes End Lower

US Stock Indexes End LowerUS Stock Indexes End Lower

U.S. stocks ended lower for a second straight day, dragged down by utility companies. Losses were broad but moderate. The Dow Jones industrial average fell 104 points, or 0.6 percent, to close at 18,011 on Tuesday. The Standard & Poor's 500 index dipped 12 points, also 0.6 percent, to 2,091. All 10 industries that make up the index fell, with utilities down the most. The Nasdaq lost 16 points, or 0.3 percent, to 4,994. Crude oil rose 6 cents to $47.51 a barrel in New York as traders anticipated the release of weekly supply information. Government bond prices rose. The yield on the 10-year Treasury note, which moves in the opposite direction -

Afternoon News Flash - New York Session 25.03.15

Afternoon News Flash - New York Session 25.03.15Afternoon News Flash - New York Session 25.03.15

Hello super-traders and welcome to today’s New York Session News Flash. During this session we'll summarize the Asian market trading session results, go over European market's recent movements, get ready for the New York market session, and of course, we'll review the hottest assets in the markets. Let's Begin Starting with the Asian markets Asian stocks slumped yesterday following poor Chinese Manufacturing PMI Prints, but they are pairing yesterday's losses and heading towards 6-month-highs. The Japanese Nikkei 2-25 index is up 20 points with a current value of 19,680. The Japanese Yen advanced at the beginning of the week following Ban -

Marc Faber on Stocks, The Markets and The

Marc Faber on Stocks, The Markets and TheMarc Faber on Stocks, The Markets and The

Marc Faber Gold Price, US Dollar & the Swiss Gold Initiative. goldbroker news marc-faber-gold-us-dollar-china-swiss-gold-referendum-649 goldbroker news ... Marc Faber-Still Sees Some Opportunities in Stocks .... Marc Faber believes that the tech sector is in a bubble that is about to pop. He has always been a firm believer of gold and hard assets. Which would you rather own? Many investors have speculated... Please visit the main Wall St for Main St website here: Wall St for Main St interviewed the editor of The Gloom Boom Doom report, Dr. Marc Faber. In this podcast, we asked Dr. Faber about... for details Marc Faber : Mature economi -

Stock slump makes it two in a row

Stock slump makes it two in a rowStock slump makes it two in a row

U.S. stocks closed lower for the 2nd straight session as traders focused on the dollar's strength and its possible impact on corporate earnings.

- Duration: 0:47

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 5

- Duration: 13:01

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 1

- Duration: 12:09

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 5

- Duration: 13:36

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 4

- Duration: 1:31

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 0

- Duration: 3:09

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 0

- Duration: 3:27

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 8

- Duration: 3:27

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 1

- Duration: 2:31

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 22

- Duration: 6:58

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 1

- Duration: 9:09

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 1

- Duration: 8:12

- Updated: 26 Mar 2015

- published: 26 Mar 2015

- views: 64

- Duration: 0:54

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 2

- Duration: 46:18

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 6

- Duration: 0:58

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 4

- Duration: 2:49

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 16

- Duration: 4:32

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 0

- Duration: 0:47

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 11

- Duration: 1:08

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 436

- Duration: 1:02

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 0

- Duration: 3:32

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 12

- Duration: 15:29

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 3

- Duration: 1:39

- Updated: 25 Mar 2015

- published: 25 Mar 2015

- views: 0

- Playlist

- Chat

U.S. Stocks Start Mixed as Traders Focus on CPI Report